Weather News (4825) 、UACJ (5741) 、San-oh Industries (6584) 、Bank of the Ryukyus (8399)

Weather News (4825)

6400 yen (closing price on 9/8)

■Established in 1986. The company collects and processes data on natural phenomena, including weather, together with its clients, and provides content, including weather forecast-based business support for BtoB (corporate clients) and information content for BtoS (social clients).

■For the fiscal year ending May 31, 2023, announced on July 6, 2023, the company forecasts net sales of 21.114 billion yen (up 7.4% year-on-year) and operating income of 3.256 billion yen (up 12.1% year-on-year). The company’s sales increased 7.4% y-o-y to 21.114 billion yen, and operating profit grew 12.1% y-o-y to 3.256 billion yen.

■The company plans a 6.6% y-o-y rise in sales to 22.5 billion yen, a 7.5% y-o-y rise in operating profit to 3.5 billion yen, and a 10-yen y-o-y increase in the annual dividend to 120 yen. Based on the foundation established by the brand with high forecasting accuracy in the mobile and Internet weather business, the company plans to strengthen its contribution to the global environment in its new medium-term business plan for the three years from June 2023, including CO2 reduction in the navigation weather business, climate change risk analysis in the climate tech business, and renewable energy generation forecasting.

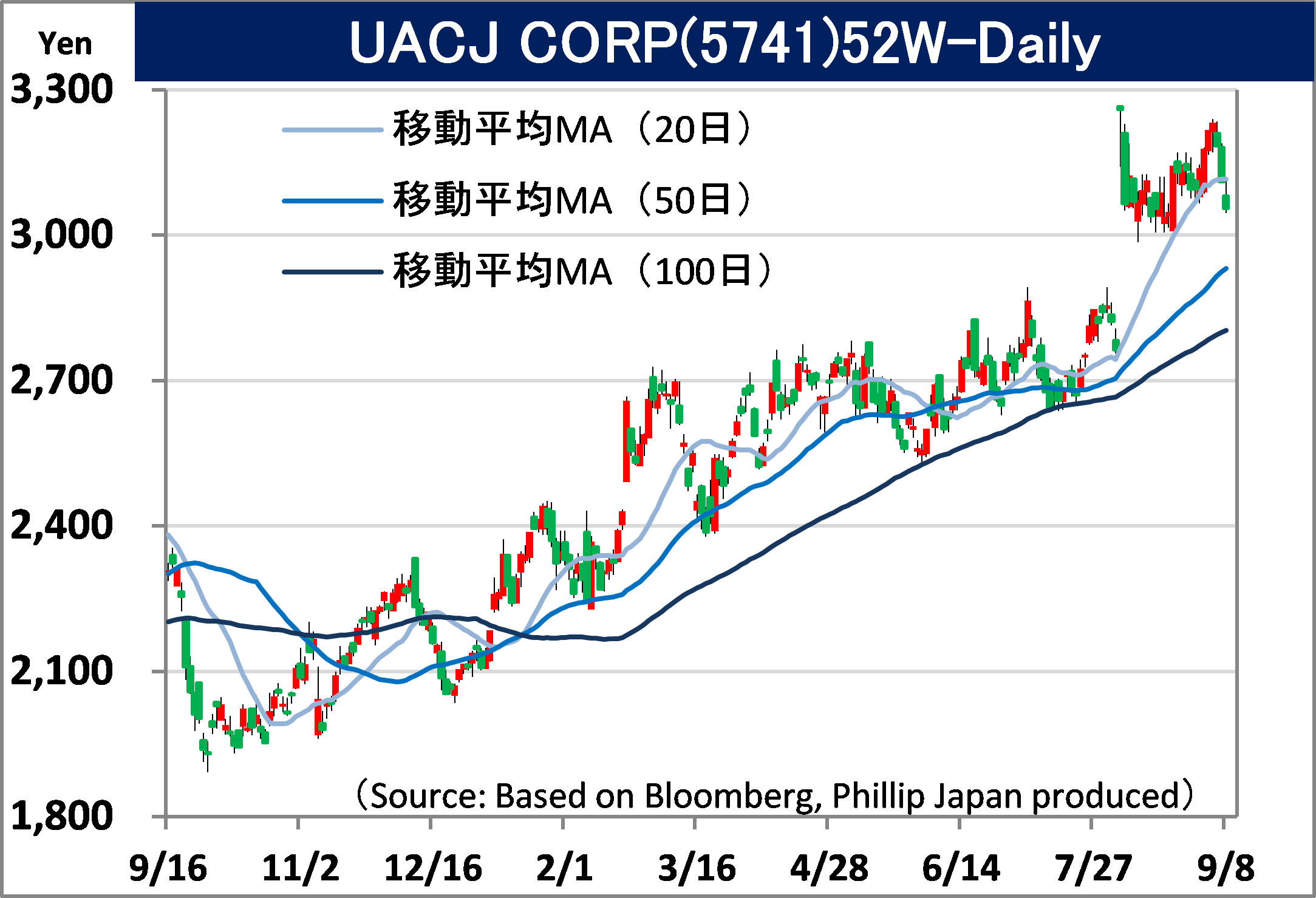

UACJ (5741)

3055 yen (closing price on 9/8)

■A subsidiary of Furukawa Electric Co. Furukawa Electric (5801) is the largest shareholder with a 24.9% stake. The company has the largest production capacity for rolled aluminum products in Japan and the third largest in the world after Alcoa and Novelis in the U.S.

■A subsidiary of Furukawa Electric Co. Furukawa Electric (5801) is the largest shareholder with a 24.9% stake. The company has the largest production capacity for rolled aluminum products in Japan and the third largest in the world after Alcoa and Novelis in the U.S.

■In the 1Q (April-June) of FY2024/3, sales declined 17.6% y-o-y to 211.1 billion yen, and operating profit fell 53.9% y-o-y to 8.177 billion yen. Although sales of automotive-related materials were on a recovery trend due to the easing of the global semiconductor shortage, domestic sales volume declined due to lower demand for can materials and downturns in demand for semiconductor manufacturing equipment, electrical machinery, and construction materials. Aluminum ingot prices also declined.

■The company’s full-year forecasts call for net sales of 970 billion yen (up 1.6% year-on-year), operating income of 34 billion yen (up 3.2 times), and annual dividends of 85 yen (unchanged from the previous year). The company’s “GIGACAST” technology, in which the entire car body is integrally formed by aluminum die casting, has enabled Tesla of the U.S. to take the lead in reducing the weight of electric vehicle (EV) car bodies and reducing the number of parts and costs.

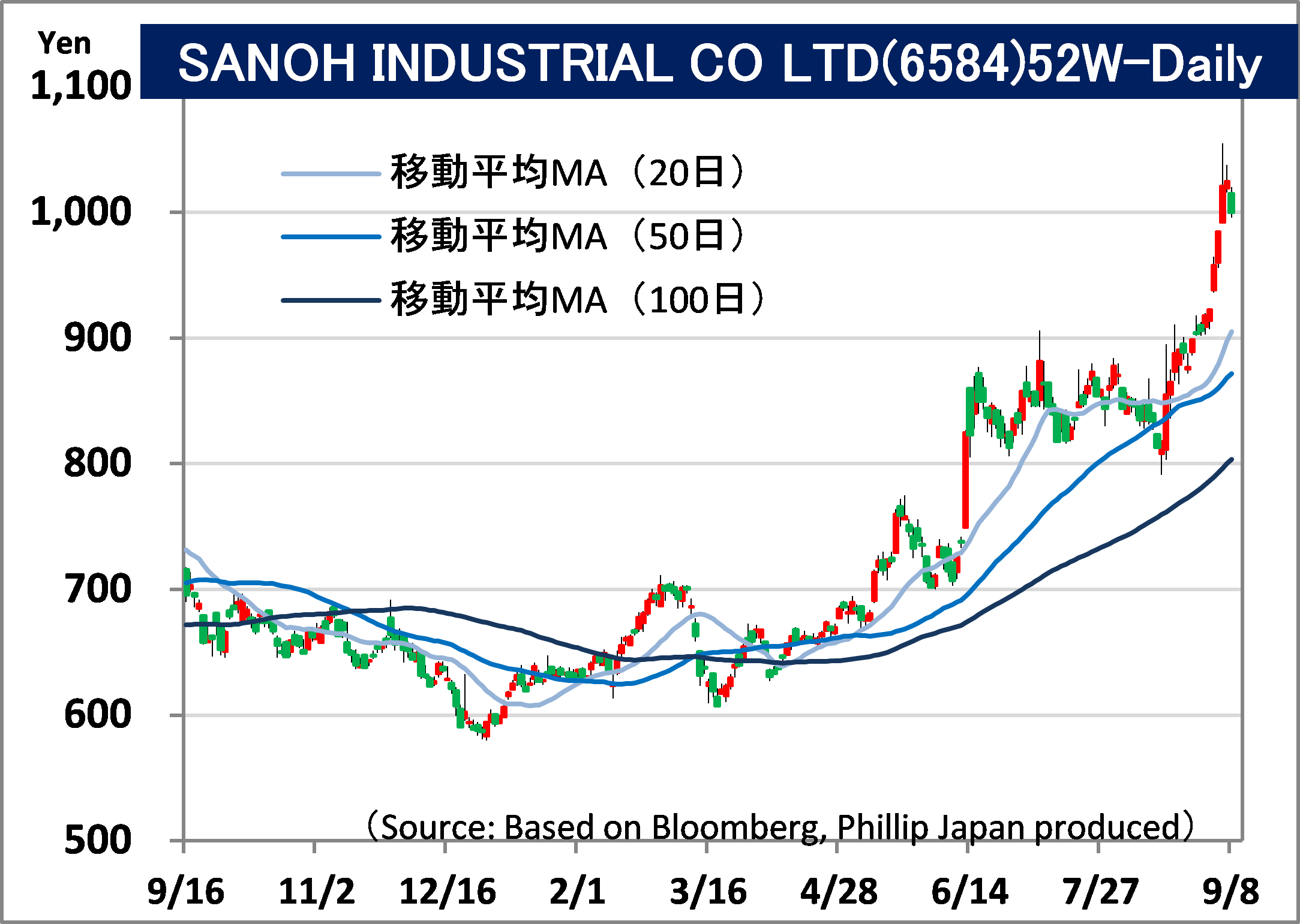

San-oh Industries (6584)

1000 yen (closing price on 9/8)

■Established in 1939 in Omiya City, Saitama Prefecture, for the manufacture of aircraft parts. The company manufactures and sells electric parts and equipment as well as automotive parts with respect to double- and single-wound steel tubes. The company operates in Japan, North and South America, Europe, China, and Asia.

■In the 1Q (April-June) of FY2024/3 announced on August 10, 2023, sales increased 17.4% y-o-y to 36.446 billion yen, and operating profit increased 8.4 times y-o-y to 1.112 billion yen. In addition to the increase in sales due to the recovery of production as the semiconductor shortage and supply chain disruption subsided and the yen’s depreciation, improved profitability due to price pass-through and stabilized utilization conditions contributed to profit.

■The company’s full-year forecasts call for net sales of 146 billion yen (up 6.0% y-o-y), operating income of 4 billion yen (up 3.0 times y-o-y), and annual dividend of 25 yen (unchanged y-o-y). In June, the company received a new order from Sterantis G, the world’s fourth largest automaker, for brake pipes for small SUVs (sport utility vehicles), and is leveraging its strength as an independent company.

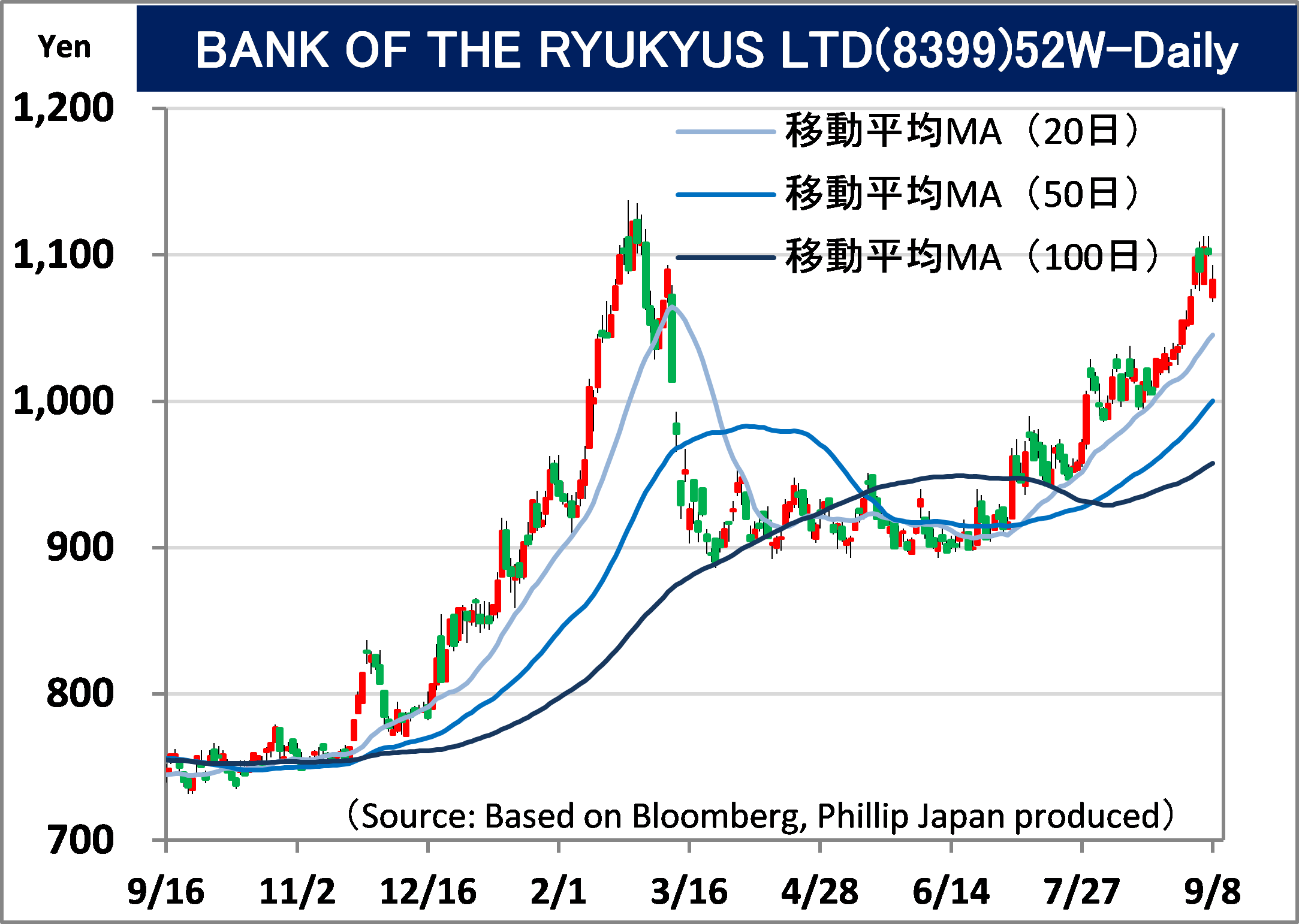

Bank of the Ryukyus (8399)

1083 yen (closing price 9/8)

■The Bank of the Ryukyus (8399) was established in 1948 and has the largest share of deposits and loans in Okinawa Prefecture. In addition to its main banking business, the company operates leasing, credit card, and credit guarantee businesses through its subsidiaries. Signed “Okinawa Economic Revitalization Partnership” with Bank of Okinawa.

■In the 1Q (April-June) of FY2024/3 announced on 8/8, recurring profit, or net sales, increased 13.1% YoY to 15.68 billion yen due to the growth of a wholly owned subsidiary engaged in systems development, etc. and mortgage loans. Net income, on the other hand, fell 3.6% y-o-y to 1.136 billion yen due to higher foreign currency procurement costs and higher personnel costs associated with base increases.

■For the full year, the company plans recurring revenue of 62.2 billion yen (up 3.5% y-o-y), net income of 5.1 billion yen (down 13.5% y-o-y), and an annual dividend of 37 yen (up 2 yen y-o-y). The company factored in a temporary increase in foreign currency procurement costs associated with foreign bond holdings and higher personnel expenses. Okinawa Prefecture will have a total fertility rate of 1.70 in 2022, much higher than the national average of 1.26. In the medium term, housing construction and other activities are expected to grow due to population growth. In the short term, an increase in the number of foreign tourists visiting Japan is also expected.

- 上場有価証券等のお取引の手数料は、国内株式の場合は約定代金に対して上限1.265%(消費税込)(ただし、最低手数料2,200円(消費税込))、外国株式の場合は円換算後の現地約定代金(円換算後の現地約定代金とは、現地における約定代金を当社が定める適用為替レートにより円に換算した金額をいいます。)の最大1.650%(消費税込)(ただし、対面または電話でのお取引の場合、3,300円に満たない場合は3,300円)となります。

- 上場有価証券等は、株式市況、金利水準等の変動による市場リスク、発行者等の業務や財産の状況等に変化が生じた場合の信用リスク、外国証券である場合には為替変動リスク等により損失が生じるおそれがあります。また新株予約権等が付された金融商品については、これらの権利を行使できる期間の制限等があります。

- 国内の取引所金融商品市場もしくは店頭売買有価証券市場への上場が行われず、また国内において公募、売出しが行われていない外国株式等については、我が国の金融商品取引法に基づいた発行者による企業内容の開示は行われていません。

- 金融商品ごとに手数料等及びリスクは異なりますので、お取引に際しては、当該商品等の契約締結前交付書面や目論見書又はお客様向け資料をよくお読みください。

【免責事項】

- この資料は、フィリップ証券株式会社(以下、「フィリップ証券」といいます。)が作成したものです。

- 実際の投資にあたっては、お客様ご自身の責任と判断において行うようお願いいたします。

- この資料に記載する情報は、フィリップ証券の内部で作成したか、フィリップ証券が正確且つ信頼しうると判断した情報源から入手しておりますが、その正確性又は完全性を保証したものではありません。当該情報は作成時点のものであり、市場の環境やその他の状況によって予告なく変更することがあります。この資料に記載する内容は将来の運用成果等を保証もしくは示唆するものではありません。

- この資料を入手された方は、フィリップ証券の事前の同意なく、全体または一部を複製したり、他に配布したりしないようお願いいたします。

アナリストのご紹介 フィリップ証券リサーチ部

笹木 和弘

笹木 和弘

フィリップ証券株式会社:リサーチ部長

証券会社にて、営業、トレーディング業務、海外市場に直結した先物取引や外国株取引のシステム開発・運営などに従事。その後は個人投資家や投資セミナー講師として活躍。2019年1月にフィリップ証券入社後は、米国・アセアン・日本市場にまたがり、ストラテジーからマクロ経済、個別銘柄、コモディティまで多岐にわたる分野でのレポート執筆などに精力的に従事。公益社団法人 日本証券アナリスト協会検定会員、国際公認投資アナリスト(CIIA®)。