Kameda Seika (2220)、Kuraray (3405)、Nippon Paper Industries (3863)、Hokuhoku Financial Group (8377)

Kameda Seika (2220)

4485 yen (closing price 9/1)

Established in Kameda-cho, Nakakanbara-gun, Niigata Prefecture in 1957. The company’s main business is the manufacture and sale of confectioneries, and it also operates a domestic rice cracker business, an overseas business, a food business, and other businesses such as freight forwarding. The company is Japan’s largest manufacturer of rice crackers such as rice crackers.

In the 1Q (April-June) of FY2024/3, sales declined 4.6% y-o-y to 22.22 billion yen, and operating profit fell 44.0% y-o-y to 699 million yen. In addition to a reactionary decline from the replacement demand in the same period of the previous year due to the fire at the Sanko Seika factory, long-term preserved foods were also affected by a reactionary decline in individual consumption, which had increased in the same period of the previous year due to the earthquake and other factors.

The company plans a 2.6% y-o-y rise in sales to 97.5 billion yen, a 26.2% y-o-y rise in operating profit to 4.5 billion yen, and a 1-yen increase in the annual dividend to 56 yen. On August 28, the company announced its “Medium- to Long-term Growth Strategy 2030. Under CEO Geneja’s leadership, the company is aiming for an asset-light and highly profitable business model by utilizing domestic and overseas alliances while expanding its business domain and countries of operation through upfront investment and technology transfer not only in the domestic rice cracker business but also in the overseas business and food business.

Kuraray (3405)

1689.5 yen (closing price 9/1)

Kurashiki Kinzoku (Kenshoku) was established in 1926 in Kurashiki, Okayama Prefecture, with Magosaburo Ohara (founder of Ohara Museum of Art) as president. The company operates six business divisions: Vinyl Acetate, Isoblen, Functional Materials, Fibers & Textiles, Trading, and Others.

In the first half of FY2023/12 (January-June), announced on August 9, 2024, sales increased 6.4% y-o-y to 38.098 billion yen, and operating profit increased 7.6% y-o-y to 40.970 billion yen. Sales of vinyl acetate, which accounts for 52% of total sales, increased 7% y-o-y, and operating income rose 20% y-o-y, while sales of functional materials, including environmental solutions such as activated carbon, increased 20% y-o-y, and operating income rose 74%.

The company’s full-year forecasts call for net sales of 810 billion yen (up 7.1% y-o-y) and operating income of 84 billion yen (down 3.6% y-o-y). The annual dividend was revised upward. The company raised its annual dividend by 6 yen to 50 yen (previous plan: 48 yen). Water sources in Kakamigahara City, Gifu Prefecture, detected organic fluorine compounds (PFAS) that exceeded the government’s provisional target values. The city announced the introduction of a removal system using activated carbon at the water source. According to Deal Labs, the company has the largest share of the global activated carbon market with approximately 20% in 2020.

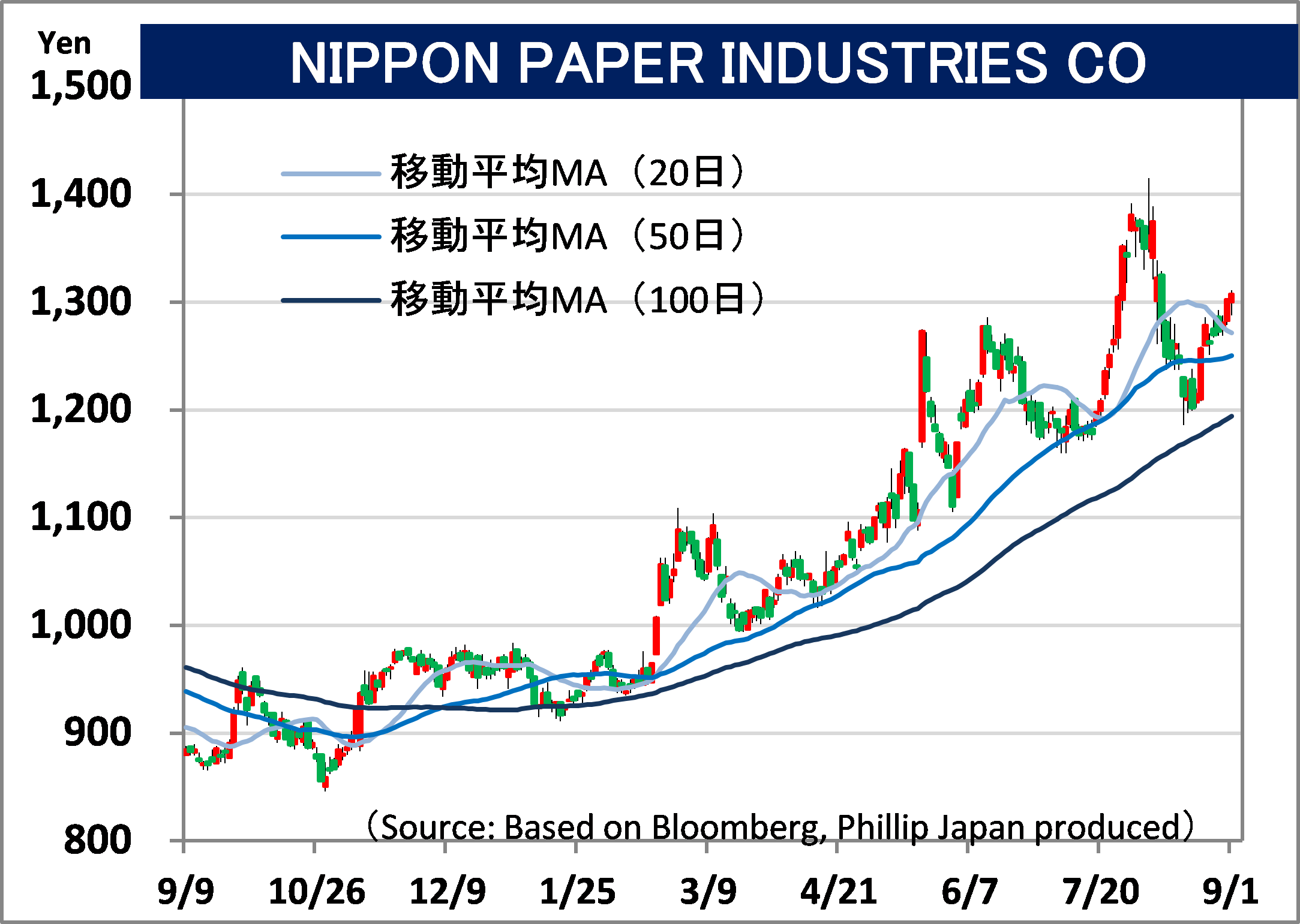

Nippon Paper Industries (3863)

1308 yen (closing price 9/1)

Nippon Paper Industries succeeded the second company (Jujo Paper) of the former Oji Paper in 1949. The company’s main businesses are paper and paperboard, lifestyle-related business, energy business, and wood, building materials, and civil engineering and construction-related business. Famous for its Scotty and Kleenex household paper products.

In the 1Q (April-June) of FY2024/3 announced on August 7, 2024, sales increased 8.6% y-o-y to 287.424 billion yen, and operating profit turned to the black from -2.924 billion yen in the 1Q of FY2023 to 812 million yen. Sales increased due to the contribution of price hikes for various products. Operating profit returned to the black due to cost improvement and fixed cost reduction. Final deficit due to extraordinary loss from withdrawal from graphic paper business.

The company’s full-year plan calls for net sales of 1.23 trillion yen (up 6.7% y-o-y) and operating income of 24.0 billion yen (down from -26.855 billion yen in the previous year). On August 30, 2024, the company announced that it had sold the land and buildings of a commercial facility in Oji, Kita-ku, Tokyo, and that it would post a gain on sales of fixed assets of approximately 25.4 billion yen in extraordinary income for the fiscal year ending March 2024. In addition to improved performance, the company’s financial soundness due to reduced net interest-bearing debt resulting from the conversion of non-core business assets into cash should contribute to higher P/B ratios.

Hokuhoku Financial Group (8377)

1331.5 yen (closing price on 9/1)

Established in 2003 through the merger of Hokuriku Bank (Toyama Prefecture) and Hokkaido Bank. Formed a broad regional financial group centered on Hokkaido and three Hokuriku prefectures. In addition to its banking business, the company also offers securities, leasing, credit cards, and software development services.

The two banks’ combined results for 1Q (Apr-Jun) of FY2024/3 announced on July 31 are as follows Core business profit declined 12.8% YoY to 27.993 billion yen due to a decrease in net interest income resulting from an increase in foreign currency funding costs, despite an increase in net fees and commissions. Core operating profit fell 31.0% y-o-y to 8.983 billion yen. Ordinary profit declined 18.8% YoY, despite lower losses on bond transactions and credit costs.

The company’s full-year forecasts (consolidated basis) are: recurring profit of 26.0 billion yen (down 1.5% YoY), net income of 17.0 billion yen (down 20.7% YoY), and annual dividend unchanged at 37 yen, mainly due to a 5% wage hike and increased system-related expenses. Rapidus, which aims to manufacture cutting-edge semiconductors, plans to start construction of a plant in Chitose City, Hokkaido, this September. Furthermore, real estate in Hokkaido is also popular among foreign visitors to Japan. The Shinkansen line is scheduled to open in Kanazawa and Tsuruga in 2024, and Hakodate and Sapporo are targeted to open in 2030.

- 上場有価証券等のお取引の手数料は、国内株式の場合は約定代金に対して上限1.265%(消費税込)(ただし、最低手数料2,200円(消費税込))、外国株式の場合は円換算後の現地約定代金(円換算後の現地約定代金とは、現地における約定代金を当社が定める適用為替レートにより円に換算した金額をいいます。)の最大1.650%(消費税込)(ただし、対面または電話でのお取引の場合、3,300円に満たない場合は3,300円)となります。

- 上場有価証券等は、株式市況、金利水準等の変動による市場リスク、発行者等の業務や財産の状況等に変化が生じた場合の信用リスク、外国証券である場合には為替変動リスク等により損失が生じるおそれがあります。また新株予約権等が付された金融商品については、これらの権利を行使できる期間の制限等があります。

- 国内の取引所金融商品市場もしくは店頭売買有価証券市場への上場が行われず、また国内において公募、売出しが行われていない外国株式等については、我が国の金融商品取引法に基づいた発行者による企業内容の開示は行われていません。

- 金融商品ごとに手数料等及びリスクは異なりますので、お取引に際しては、当該商品等の契約締結前交付書面や目論見書又はお客様向け資料をよくお読みください。

【免責事項】

- この資料は、フィリップ証券株式会社(以下、「フィリップ証券」といいます。)が作成したものです。

- 実際の投資にあたっては、お客様ご自身の責任と判断において行うようお願いいたします。

- この資料に記載する情報は、フィリップ証券の内部で作成したか、フィリップ証券が正確且つ信頼しうると判断した情報源から入手しておりますが、その正確性又は完全性を保証したものではありません。当該情報は作成時点のものであり、市場の環境やその他の状況によって予告なく変更することがあります。この資料に記載する内容は将来の運用成果等を保証もしくは示唆するものではありません。

- この資料を入手された方は、フィリップ証券の事前の同意なく、全体または一部を複製したり、他に配布したりしないようお願いいたします。

アナリストのご紹介 フィリップ証券リサーチ部

笹木 和弘

笹木 和弘

フィリップ証券株式会社:リサーチ部長

証券会社にて、営業、トレーディング業務、海外市場に直結した先物取引や外国株取引のシステム開発・運営などに従事。その後は個人投資家や投資セミナー講師として活躍。2019年1月にフィリップ証券入社後は、米国・アセアン・日本市場にまたがり、ストラテジーからマクロ経済、個別銘柄、コモディティまで多岐にわたる分野でのレポート執筆などに精力的に従事。公益社団法人 日本証券アナリスト協会検定会員、国際公認投資アナリスト(CIIA®)。