■Pick up stocks:Besterra (1433)、Digital Media Pro (3652)、Anvis Holdings (7071)、NTT(9432)

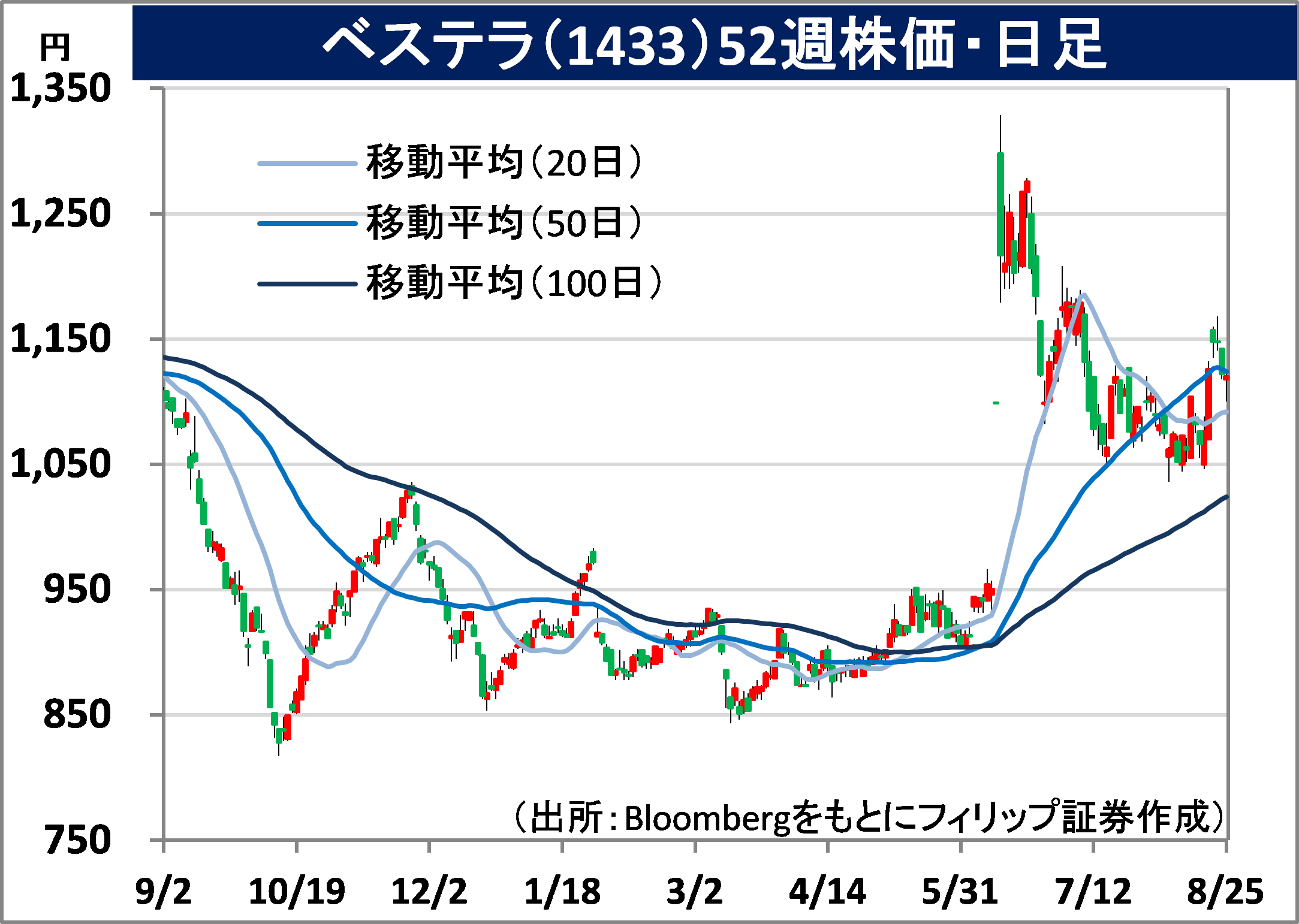

Besterra (1433)

1120 yen (closing price 8/25)

Founded in 1974 in Nagoya, Japan, this company specializes in plant dismantling work. The company has its own patented demolition methods for cutting and dismantling large storage tanks, such as the “apple peeling method” and the “windmill tipping method,” which realize decarbonization demolition.

In the 1Q (February-April) of FY2024/1 announced on 6/9, sales declined 8.6% y-o-y to 1.537 billion yen, and operating profit declined from 196 million yen in 1Q FY2024/1 to -35 million yen. While orders for new large-scale construction projects were strong, the start of construction on new orders is expected to be concentrated in 2Q and later, and some low-margin construction projects pushed down profit margins.

The company’s full-year forecasts call for net sales of 7.8 billion yen, up 42.9% year-on-year; operating income of 510 million yen, up from -215 million yen in the previous year; and annual dividends of 20 yen, unchanged from the previous year. The company expects to benefit from the decommissioning and dismantling of nuclear power plants in Japan through its business alliance with Hitachi Plant Construction, as well as the trend toward decommissioning inefficient and aging coal-fired thermal power plants in pursuit of a de-carbonized society. The steel and chemical industries will also continue to upgrade their facilities and restructure their plants.

Digital Media Professional (3652)

¥2,600 (closing price 8/25) *TSE Growth Listing

Established in 2002. Develops graphics IP cores and provides semiconductor IP cores to semiconductor and end-product manufacturers for inclusion in game consoles, automobiles, mobile communication devices, etc. It also manufactures and sells LSI products.

In the 1Q (April-June) of FY2024/3 announced on 8/9, sales increased 80.3% y-o-y to 699 million yen, and operating profit returned to the black from -89 million yen in the same period of the previous year to 30 million yen. Sales by segment were up 90% y-o-y to 630 million yen in the mainstay Amusement business due to mass production shipments of the next-generation image processing semiconductor “RS1,” and up 5.8 times y-o-y to 23 million yen in the Robotics business.

The company’s full-year plan calls for sales of 2.6 billion yen, up 12.0% y-o-y, and operating profit of 150 million yen, up 5.5 times y-o-y. Since its founding, the company has focused on image processing, low-power IP, and artificial intelligence (AI). The “ChatGPT” generative AI also has a beta version of “GTP4” that can input images. The new image processing AI system will lead to “image intelligence” to extract various patterns from images, which will lead to higher added value for the company’s services, such as automated driving with in-vehicle cameras.

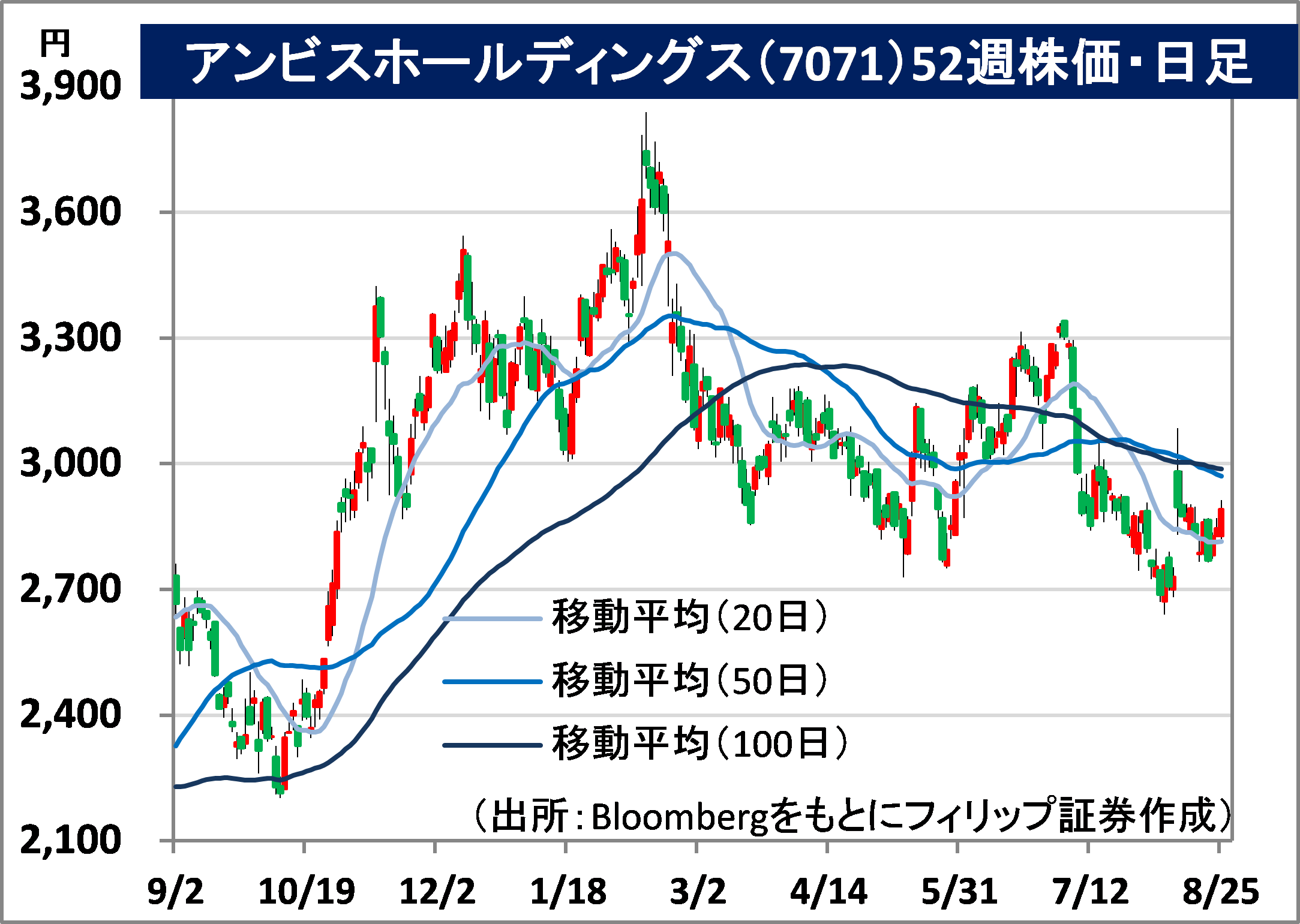

Anvis Holdings (7071)

2892 yen (closing price on 8/25)

Established in 2013 in Kuwana City, Mie Prefecture. Kanto region. Established in 2013 in Kuwana City, Mie Prefecture. Comprehensive development of home nursing, in-home nursing care support, and fee-based nursing homes. Specializes in chronic and end-of-life nursing care.

The number of facilities as of the end of June increased by 14 y-o-y to 70 facilities, and the number of residents increased by 28% y-o-y to 3,446. The occupancy rate of existing facilities was 86.6%, exceeding the standard occupancy rate of 82-85%. In March of this year, the market was changed to the Tokyo Stock Exchange’s Prime Stock Market.

The company plans a 33.0% y-o-y increase in sales to 30.682 billion yen, a 28.4% y-o-y increase in operating profit to 7.872 billion yen, and a flat annual dividend (after taking into account the stock split) of 3 yen per share. Thereafter, the company plans 101 facilities with a capacity of 4,974 persons at the end of September 2012, and 127 facilities with a capacity of 6,328 persons at the end of September 2013. While annual domestic deaths and cancer deaths are expected to increase until 2040 according to the Ministry of Health, Labour and Welfare’s Vital Statistics, the current trend is for a decrease in hospital deaths and home deaths, and an increase in institutional deaths.

NTT(Nippon Telegraph and Telephone Corporation) (9432)

165.1 yen (closing price 8/25)

Nippon Telegraph and Telephone Public Corporation was established in 1952 with full government funding and privatized in 1985. NTT DOCOMO became a wholly owned subsidiary at the end of 2020. NTT currently owns 57.7% of NTT DATA Group (9613), and the government is required by NTT Law to hold at least one-third of NTT’s outstanding shares.

In the 1Q (April-June) of FY2024/3 announced on 8/9, operating revenue increased 1.4% y-o-y to 3,111.0 billion yen, and operating profit decreased 5.7% y-o-y to 474.6 billion yen. Operating profit decreased due to sluggish regional telecom business and the burden from the overseas business integration with NTT DATA, but final profit increased by 2.0% y-o-y due to the contribution of financial revenue from the partial sale of IIJ shares. NTT DOCOMO’s operating revenue increased.

The company plans operating full year’s revenue of 13.06 trillion yen (down 0.6% y-o-y), operating profit of 1.95 trillion yen (up 6.6% y-o-y), and annual dividend (after stock split) of 5.0 yen (up 0.2 yen y-o-y). While the government has proposed selling NTT shares in response to a cabinet decision to increase defense spending, the company has also requested an amendment to the NTT Law from the viewpoint of easing regulations such as the obligation to disclose technology and the universal service system by NTT East and West. The LDP headquarters intends to finalize the direction of the law revision by the end of this year.

- 上場有価証券等のお取引の手数料は、国内株式の場合は約定代金に対して上限1.265%(消費税込)(ただし、最低手数料2,200円(消費税込))、外国株式の場合は円換算後の現地約定代金(円換算後の現地約定代金とは、現地における約定代金を当社が定める適用為替レートにより円に換算した金額をいいます。)の最大1.650%(消費税込)(ただし、対面または電話でのお取引の場合、3,300円に満たない場合は3,300円)となります。

- 上場有価証券等は、株式市況、金利水準等の変動による市場リスク、発行者等の業務や財産の状況等に変化が生じた場合の信用リスク、外国証券である場合には為替変動リスク等により損失が生じるおそれがあります。また新株予約権等が付された金融商品については、これらの権利を行使できる期間の制限等があります。

- 国内の取引所金融商品市場もしくは店頭売買有価証券市場への上場が行われず、また国内において公募、売出しが行われていない外国株式等については、我が国の金融商品取引法に基づいた発行者による企業内容の開示は行われていません。

- 金融商品ごとに手数料等及びリスクは異なりますので、お取引に際しては、当該商品等の契約締結前交付書面や目論見書又はお客様向け資料をよくお読みください。

【免責事項】

- この資料は、フィリップ証券株式会社(以下、「フィリップ証券」といいます。)が作成したものです。

- 実際の投資にあたっては、お客様ご自身の責任と判断において行うようお願いいたします。

- この資料に記載する情報は、フィリップ証券の内部で作成したか、フィリップ証券が正確且つ信頼しうると判断した情報源から入手しておりますが、その正確性又は完全性を保証したものではありません。当該情報は作成時点のものであり、市場の環境やその他の状況によって予告なく変更することがあります。この資料に記載する内容は将来の運用成果等を保証もしくは示唆するものではありません。

- この資料を入手された方は、フィリップ証券の事前の同意なく、全体または一部を複製したり、他に配布したりしないようお願いいたします。

アナリストのご紹介 フィリップ証券リサーチ部

笹木 和弘

笹木 和弘

フィリップ証券株式会社:リサーチ部長

証券会社にて、営業、トレーディング業務、海外市場に直結した先物取引や外国株取引のシステム開発・運営などに従事。その後は個人投資家や投資セミナー講師として活躍。2019年1月にフィリップ証券入社後は、米国・アセアン・日本市場にまたがり、ストラテジーからマクロ経済、個別銘柄、コモディティまで多岐にわたる分野でのレポート執筆などに精力的に従事。公益社団法人 日本証券アナリスト協会検定会員、国際公認投資アナリスト(CIIA®)。